Discover our solutions for your type of business

Fraud prevention

Financial Institutions

Innovation-led protection to combat fraud and safeguard trust — preserving your institution’s reputation in a complex financial environment.

Merchants and Corporate Clients

We apply advanced technology to prevent fraud, protect your brand, and ensure secure, seamless payment experiences for your customers.

Capabilities that secure your payments and mitigate losses

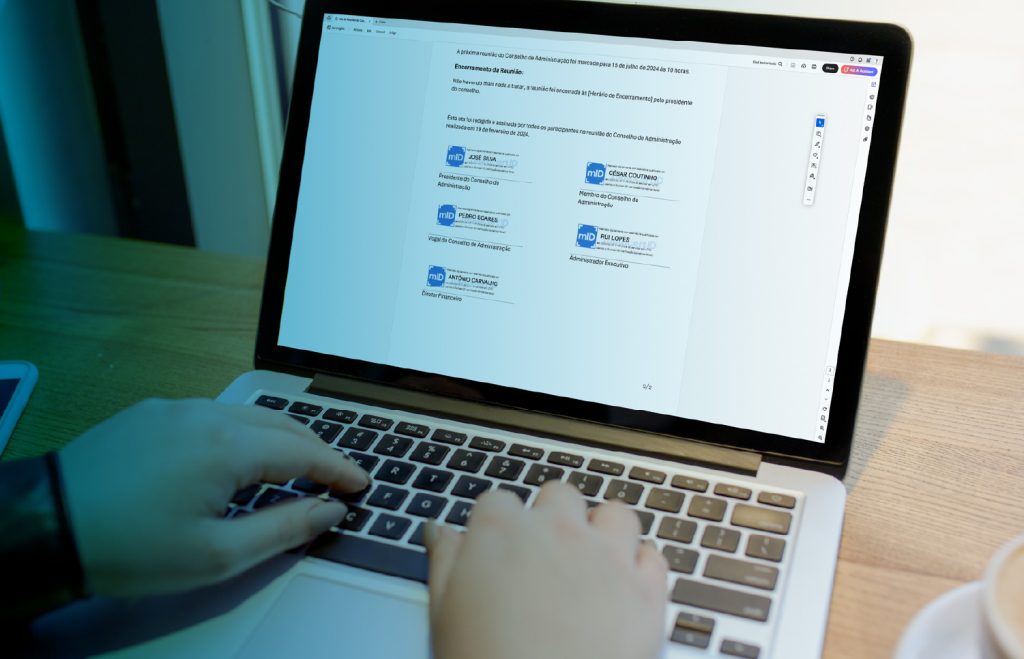

PAYWATCH Portal

An intelligent fraud-prevention platform that anticipates risk, accelerates investigations, supports better decisions, and strengthens trust. Consolidates dashboards, fraud reporting, and integrated communications in one place for greater security and agility.

Chargebacks and Disputes

An outsourcing service that reduces costs and financial losses by resolving accounting and operational issues related to card-transaction anomalies.

- Covers all card brands issued by SIBS clients.

- Supports purchases and cash withdrawals made with brands accepted within the MULTIBANCO network.

Anti-fraud Confirmation (Interactive SMS)

Fast, efficient verification of suspicious or declined transactions.

- Confirm transaction authenticity to improve fraud-detection models.

- Reduce unnecessary declines to reinforce trust and enhance customer experience.

Digital Banking Customized Model

Real-time protection across all digital channels.

PAYWATCH monitors digital banking activity in real time across channels. Designed to adapt to each financial institution’s needs, it helps detect fraud early, accelerate response, and improve decision-making, with the flexibility to integrate custom security layers while preserving a smooth customer experience.

Born local. Grown global.

Transactions per day, monitored in real-time

Machine Learning Models

Fraud prevention rules

Portugal maintains the 2nd lowest card fraud rates in the EEA

Portugal

Extensive expertise in multi-institution,

multi-channel, centralized fraud prevention

Expert fraud analysts 24/7

Suspicious-activity alerts generated by machine-learning models are reviewed by fraud analysts, ensuring rapid, accurate decisions and support when needed.

AI that learns and evolves

Models adapt to emerging fraud patterns, learning from network-wide data to improve detection accuracy and reduce false positives.

Real-time fraud detection

Transactions are monitored in real time, enabling immediate anomaly detection and swift response to potential fraud.

SIBS PAYWATCH operates across multiple countries,

following SIBS’ international footprint.

Related products