Discover our solutions for your type of business

Other financial services (SWIFT and Instant Payments)

Merchants and Corporate Clients

Send and receive international payment instructions, manage treasury operations, and communicate with banks worldwide in a standardised, reliable way.

Financial Institutions

Use our SWIFT services to exchange financial messages quickly and securely with institutions across the globe. Explore Instant Payments services for PSPs, A2A, and interbank use cases.

Our current locations

SWIFT services across three continents

Active in Europe (Portugal, Spain, France, the United Kingdom, Poland), Africa (Mozambique, Angola, Cabo Verde, Namibia), and Asia (Macao, Timor-Leste), ensuring secure, reliable international transactions.

Instant Payments in key European markets

Enabling Instant Payments in Portugal, Spain, France, and Luxembourg — supporting real-time transactions with speed, security, and compliance.

Born local. Grown global.

Total transactions processed – SEPA, SWIFT, TARGET in 2024

SWIFT transactions processed in 2024

YoY increase in Instant Payments processing volumes

Instant Payments initiated in mobile channels

Robust capabilities in high-performance

payments and secure SWIFT operations

Reliable and resilient infrastructure

99.999% SWIFT availability, with redundant environments and regular disaster-recovery exercises.

Lower costs through shared services

Shared SWIFT infrastructure and licensing reduce costs, with pricing aligned to your business model.

High-performance, always-on payments

Real-time Instant Payments processing with continuous availability (24/7), powered by fully certified EU data centres.

End-to-end Payments Expertise

One of Europe’s largest Instant Payments processors, managing the full payment lifecycle across multiple channels and systems.

Discover more about our financial services

SWIFT services

- FIN, FINPlus/XML, FileAct, and API subscriptions

- SWP Interface licensing

- SAA and SAG licensing

- Compatibility with any SWIFT service subscription

SIBS infrastructure

- Gold connectivity for the primary site; Silver for the secondary site

- Communications systems (MQ, SFTP, FTPS, MFT with TLS, and others)

- Software and hardware for SAA and SAG (clustered; redundancy across primary and secondary sites)

Dedicated SIBS services

- Helpdesk Security Management Team (8/5)

- Helpdesk Specialised Technical Support Team (24/7)

- Dedicated Project Manager during Setup

- Dedicated Relationship Manager for ongoing operations

Functionalities that secure your payments and mitigate losses

Multiple Use Cases for Financial Institutions

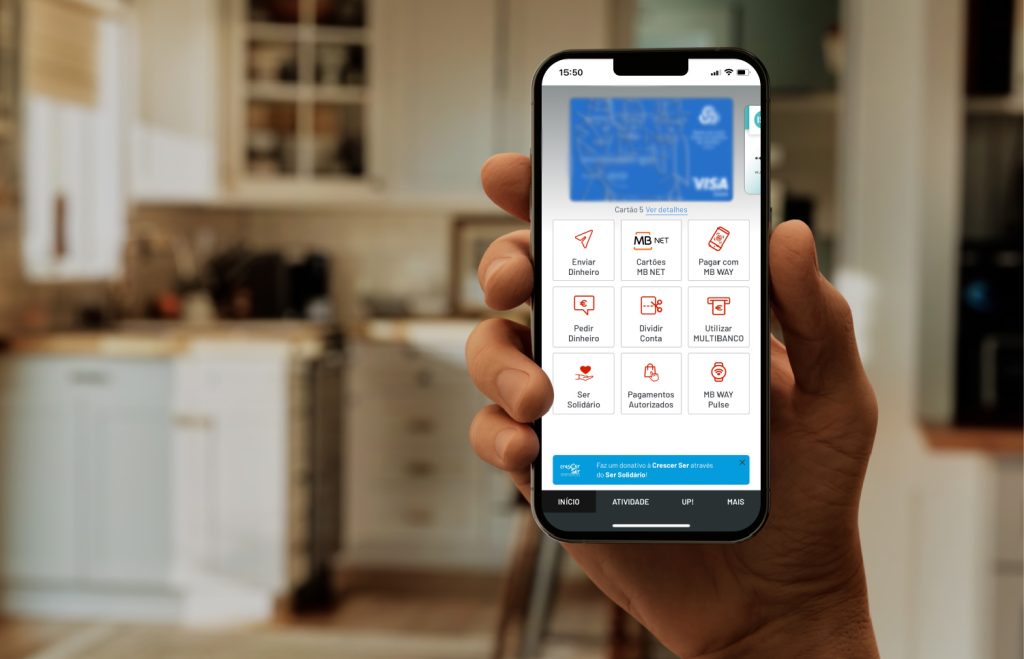

The IPS platform supports P2P, B2B, P2B, and B2P use cases with a use-case-agnostic design. Deploy via banking channels or directly connected payment solutions (e.g., MB WAY) to create new revenue streams.

Interoperable with TIPS for SEPA-wide Reach

Seamless interoperability with TIPS enables instant payments across the SEPA region, ensuring fast, reliable transactions.

Real-time Fraud Monitoring

Continuous transaction monitoring helps prevent fraud and protects payments instantly.

Standard reconciliation

A standardised reconciliation process ensures accurate and consistent transaction records.

Related products